Recall that net income or loss is closed to retained earnings. Retained earnings shows the company’s accumulated earnings (or deficit in the case of losses) less dividends paid. For ASPE companies, there is no comprehensive income (OCI) and therefore no AOCI account in equity. With this simpler reporting requirement, ASPE companies report retained earnings in the balance sheet and detail any changes in retained earnings that took place during the reporting period in the statement of retained earnings. An example of a statement of retained earnings is that of Arctic Services Ltd., for the year ended December 31, 2020.

| Arctic Services Ltd. Statement of Retained Earnings For the Year Ended December 31, 2020 | ||

|---|---|---|

| Balance, January 1, as reported | $ 250,000 | |

| Cumulative effect on prior years of retrospective application of changing inventory costing method from FIFO to moving weighted average (net of taxes for $5,400) | 12,600 | |

| Correction for an overstatement of net income from a prior period due to an ending inventory error (net of $3,000 tax recovery) | (7,000) | |

| Balance, January 1, as adjusted | 255,600 | |

| Net income | 80,500 | |

| Cash dividends declared | $(75,000) | |

| Stock dividends declared | (60,000) | (135,000) |

| Balance, December 31 | $201,100 | |

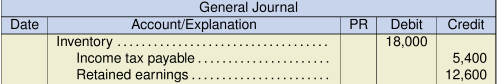

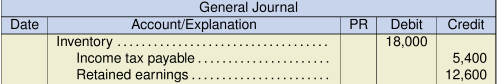

As discussed at the beginning of this chapter, any error corrections from prior periods or allowable changes in accounting policies will result in a reporting requirement to restate the opening retained earnings balance for the current period. Each error and change in accounting policy item is separately reported, net of tax, with the tax amount disclosed. The retained earnings opening balance is restated and a detailed description is included in the notes to the financial statements. The journal entry for the two restatement items for Arctic Services would be:

The statement of retained earnings also includes any current period net income or loss followed by any cash or stock dividends declared by the board of directors. This detail provides important information to investors and creditors regarding the proportion of net income that is distributed to the shareholders through a dividend compared to the net income retained for future business purposes such as investment or expansion.

ASPE companies may choose to combine the statement of income and the statement of retained earnings. In this case, the statement of retained earnings is incorporated at the bottom of the statement of income, starting with net income as shown in a simple example below:

Retained earnings, January 1

Retained earnings, December 31

The formula for retained earnings is:

Beginning balance + net income – dividends declared = Ending balance

Recall that the ending balance from one year end becomes the beginning balance of the next year.

For IFRS companies, net income is closed out to retained earnings, and other comprehensive income (OCI), if any, is closed out to accumulated other comprehensive income (AOCI). An example of how that works is illustrated in the Wellbourn financial statements included in section 3.3 of this chapter. Both retained earnings and AOCI are reported in the equity section of the statement of financial position (SFP) and the statement of changes in equity (IFRS)

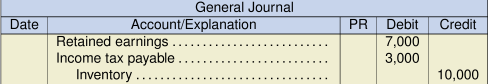

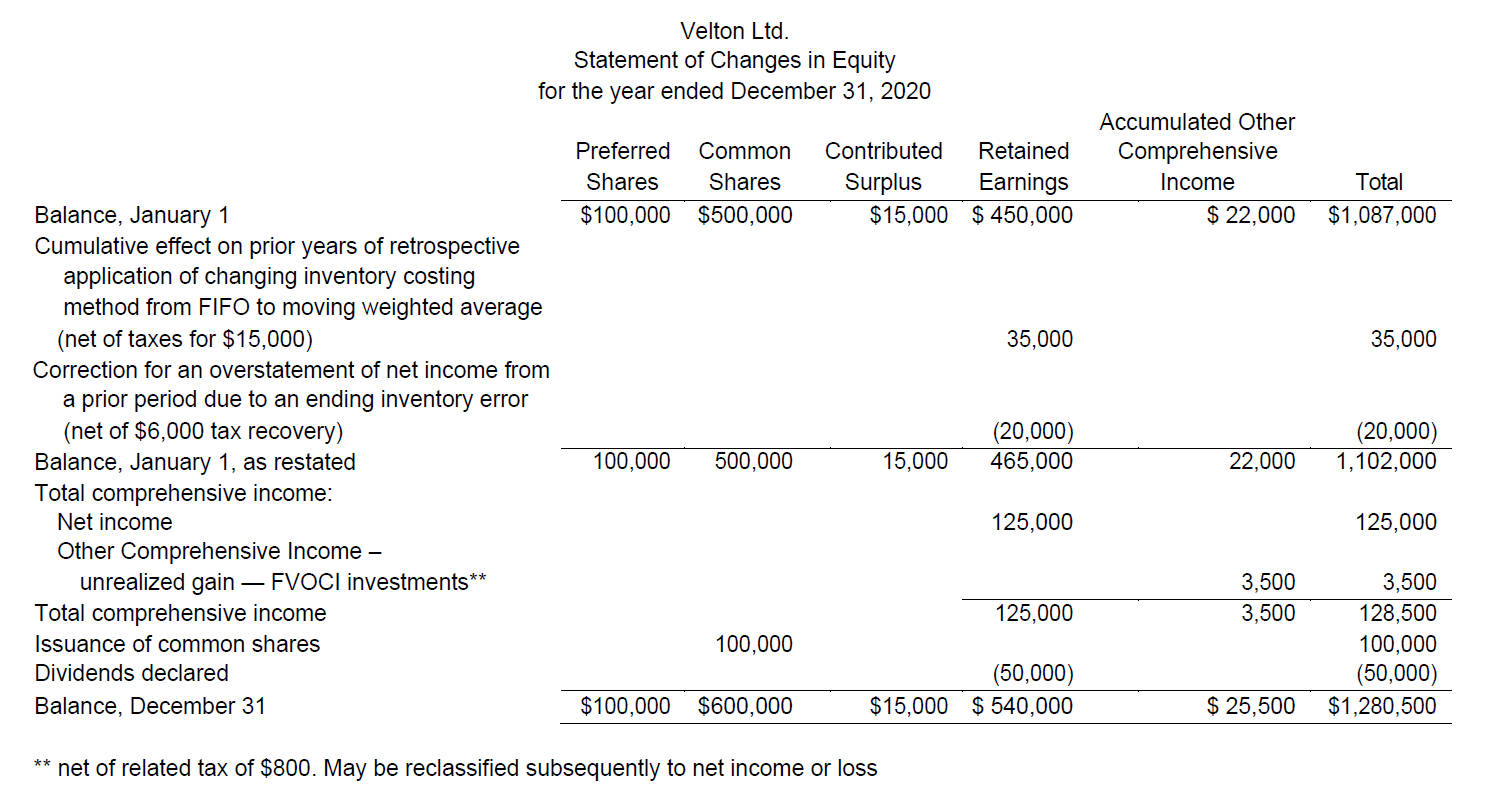

For IFRS companies, each account from the equity section of the SFP is to be reported in the statement of changes in equity. The following is an example of the statement of changes in equity for an IFRS company, Velton Ltd., for the year ended December 31, 2020. Note how this statement is worksheet style, which discloses each retrospective adjustment net of tax, followed by a restatement of the equity account opening balances. Each equity account opening balance is then reconciled to its respective closing balance by reporting the changes that occurred during the year, such as the issuance/retirement of shares, net income, and dividends. The statement also must report total comprehensive income. Any non-controlling interest would also be reported (as a separate column), the same as was required and illustrated for Toulon Ltd.’s statement of income presented earlier.

changing inventory costing method from FIFO to moving weighted average - net of taxes for $15,000: 35,000 noted under retained earnings. Correction for an overstatement of net income from a prior period due to an ending inventory error - net of $6,000 tax recovery: (20,000) noted under retained earnings. Balance Jan 1 as restated: preferred shares 100,000; common shares 500,000; contributed surplus 15,000; retained earnings 465,000; accumulated other comprehensive income 22,000; total 1,102,000. Total comprehensive income net income 125,000 under retained earnings other comprehensive income unrealized gain FVOCI investments (net of related tax of $800. May be reclassified subsequently to net income or loss) 125,000 under retained earnings Total comprehensive income 125,000 under retained earnings, 3,500 under accumulated other comprehensive income, 128,500 under total Issuance of common shares 100,00 under common shares dividends declared: 50,000 under retained earnings Balance December 31 - preferred shares: $100,000; common shares: $600,000; contributed surplus: $15,000; retained earnings: $540,000; accumulated other comprehensive income: 25,500; total: ",280,500" width="646" height="344" />

changing inventory costing method from FIFO to moving weighted average - net of taxes for $15,000: 35,000 noted under retained earnings. Correction for an overstatement of net income from a prior period due to an ending inventory error - net of $6,000 tax recovery: (20,000) noted under retained earnings. Balance Jan 1 as restated: preferred shares 100,000; common shares 500,000; contributed surplus 15,000; retained earnings 465,000; accumulated other comprehensive income 22,000; total 1,102,000. Total comprehensive income net income 125,000 under retained earnings other comprehensive income unrealized gain FVOCI investments (net of related tax of $800. May be reclassified subsequently to net income or loss) 125,000 under retained earnings Total comprehensive income 125,000 under retained earnings, 3,500 under accumulated other comprehensive income, 128,500 under total Issuance of common shares 100,00 under common shares dividends declared: 50,000 under retained earnings Balance December 31 - preferred shares: $100,000; common shares: $600,000; contributed surplus: $15,000; retained earnings: $540,000; accumulated other comprehensive income: 25,500; total: ",280,500" width="646" height="344" />

The equity portion of the SFP is shown below.

| Velton Ltd. Statement of Changes in Financial Position Shareholders’ Equity Section December 31, 2020 | |

|---|---|

| Shareholder’s equity | |

| Paid-in capital | |

| Preferred shares, non-cumulative, 2,000 authorized; 1,000 issued and outstanding | $100,000 |

| Common shares, unlimited authorized; 20,000 issued and outstanding | 600,000 |

| Contributed surplus | 15,000 |

| Retained earnings | 540,000 |

| Accumulated other comprehensive income | 25,000 |

| Total shareholders’ equity | $1,280,500 |

If the company sustained net losses over several years and retained earnings were insufficient to absorb these losses, retained earnings would have a debit balance and would be reported on the SFP as a deficit.